This information is getting academic aim simply. JPMorgan Chase Bank N.A good. will not provide such loan. Any information explained on this page can differ by financial.

An other mortgage was financing for home owners 62 and up having high family security looking more cash circulate. There are some variety of opposite mortgages, however, there are also options which could are better for the needs. Such as for example, when you find yourself handling retirement age however, would like to mention financial choice, particular possibilities as well as refinancing or a home security financing will get work top.

What is a face-to-face home loan and how will it work?

A contrary home loan is that loan having residents 62 or over which have a good number of home guarantee. This new homeowner can borrow money off a lender up against the well worth of their family and you can have the loans once the a type of borrowing otherwise monthly obligations.

Once you usually think of a mortgage, first of all may come to mind try an onward financial. An onward financial necessitates the homebuyer to blow the lending company in order to buy a property, while an opposite home loan is when the financial institution pays the homeowner contrary to the worth of their house.

Once the homeowners disperse, offer their residence or die, the reverse mortgage was repaid. In case your family depreciates during the worthy of, the newest homeowner otherwise its property is not required to expend the brand new variation if for example the financing exceeds the home worth.

Do you know the three kind of contrary mortgages?

- Single-purpose contrary mortgage loans: the most affordable choice out from the around three. He could be normally only carried out for example objective, and this can be specified by the loaner. An illustration might possibly be a large household fix, such a threshold substitute for. Single-mission opposite mortgage loans are most typical to have residents that have lower so you can reasonable money.

- Proprietary opposite mortgage loans: more pricey and most preferred getting home owners which have a high family worth, allowing the borrower to get into domestic equity thanks to an exclusive financial.

- Domestic Equity Transformation Mortgage loans (HECM): the most common, but still more pricey than single-goal mortgages. HECMs is federally backed by the You.S. Service of Property and you will Urban Advancement (HUD). Good HECM credit line usually can be studied from the homeowner’s discretion, in place of the brand new single-objective opposite mortgage loans.

What is the drawback from a reverse financial

There are a few disadvantages from a reverse mortgage. When you take away an opposing home loan it reduces the significance of your house guarantee as you happen to be borrowing up against everything currently very own. For example, for folks who very own $100K of your property and you play with $50K within the a reverse financial, you now simply individual $50K of your property.

An opposing financial might affect the possession of your property down-the-line. If you’re that have anyone or take aside an opposing financial you or they can not pay back, they may beat their lifestyle preparations in the event of good foreclosure.

Remember that no matter if a reverse home loan can provide a personal line of credit, youre nonetheless in charge of almost every other cost of living such as fees and you will insurance policies.

Eventually, be wary off who you really are borrowing from the bank money from. You will find private companies if not less legitimate lenders who you will definitely take advantage of your role otherwise give you things away from form.

Exactly what are choices to an other mortgage?

A face-to-face home loan are high priced and build far more problem involving home ownership and you can loans. Additionally there is the possibility that you might not qualify for a great contrary home loan but they are in need of assistance. Luckily for us, there are many more selection around.

- Offer your home

- Re-finance

- Apply for a house collateral financing

Offering your residence

Promoting your home commonly open cash loan usa Gurley Alabama their collateral and provide you with earnings that can exceed your own requirement in the event the household well worth has appreciated. New disadvantage to this may be that you will have to move around in. If your family has preferred inside worthy of, you can sell, downsize, and you may save or by taking more funds.

Refinance your residence

Refinancing your residence gets your straight down monthly repayments and you may provide some money. That it usually means restarting the brand new time clock on the a mortgage, but inaddition it mode potentially protecting lower interest rates.

When you yourself have high home collateral, a finances-away re-finance is recommended. A money-aside re-finance changes their mortgage which have a high mortgage than what you borrowed. The difference between their modern home loan in addition to mortgage exists for the dollars, although the mortgage is restricted to over 80 percent of home collateral unlike 100 percent.

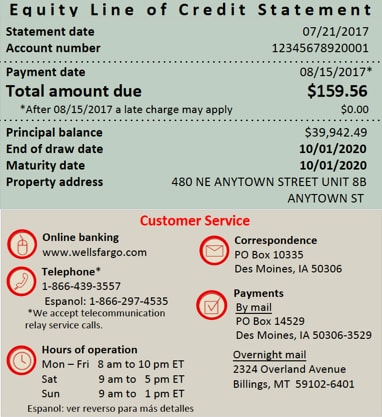

House guarantee loan

A property equity loan try a lump sum of cash considering for you by the financial, making use of your family given that collateral. Family collateral fund always render competitive rates of interest and tend to be good to possess a single-day play with, should pay a property improvement or any other expenses.

So what can opposite financial choices be taken for?

Reverse home loan options will come in the form of bucks, a personal line of credit otherwise a broad lump sum of money – based on and therefore assistance you go into the. It can be used for house fixes otherwise personal debt money, unless of course your loan criteria restriction you to a particular lead to.

Ideas on how to determine

Deciding on an opposite financial otherwise an other home loan choice would depend on your own decades, home security and you will what you want the loan to have. If you are 62 or more with lots of house guarantee, an opposite mortgage will be to you. Remember the fresh new disappointments away from a contrary home loan, particularly the decline out of family guarantee as well as how it may affect the house.

A reverse home loan is a good idea from inside the certain situations for all of us 62 or more seeking liquidate a number of their residence collateral. There are many possibilities to this version of home loan that may be better suited for both you and promote less of a headache in the act. Talk to a house Credit Coach with regards to your options.

Comentarios recientes