Borrowing from the bank Karma promises to present your credit score and you will credit file at no cost. But is it providing you an equivalent pointers one a lender often accessibility if you’re obtaining a mortgage otherwise a car or truck mortgage? And for one to amount, is-it providing you whatever you simply cannot rating someplace else?

To answer people concerns, it will help to know what Credit Karma try, what it really does, as well as how their VantageScore is different from the greater common FICO rating.

Key Takeaways

- Credit Karma gives you a free credit history and you will credit history in exchange for information about you. After that it costs entrepreneurs to help you last with focused advertising.

- Borrowing from the bank Karma’s fico scores is actually VantageScores, a rival into significantly more commonly used Credit ratings.

- Those ratings are based on everything on your own credit file out-of Equifax and you will TransUnion, a couple of around three significant credit agencies.

- Your own Credit Karma get is going to be seemingly next to their FICO score.

- The category your credit rating falls towards the (eg «good» or «pretty good») is far more extremely important as compared to right count, that will vary by the resource and can move from time in order to go out.

What is actually Borrowing from the bank Karma?

Credit Karma is the best recognized for its free credit scores and you can credit reports. Yet not, it ranks in itself a great deal more broadly as the an internet site . whose «long-label attention is to try to speed up the latest tedium of funds very people normally save money time in the facts plus go out way of life their best life.»

To utilize Borrowing Karma, you have got to give the organization some basic personal data, always only your identity while the last five digits of the Public Security count. With your permission, Borrowing from the bank Karma then accesses your own credit history, computes a great VantageScore, and you will makes it available.

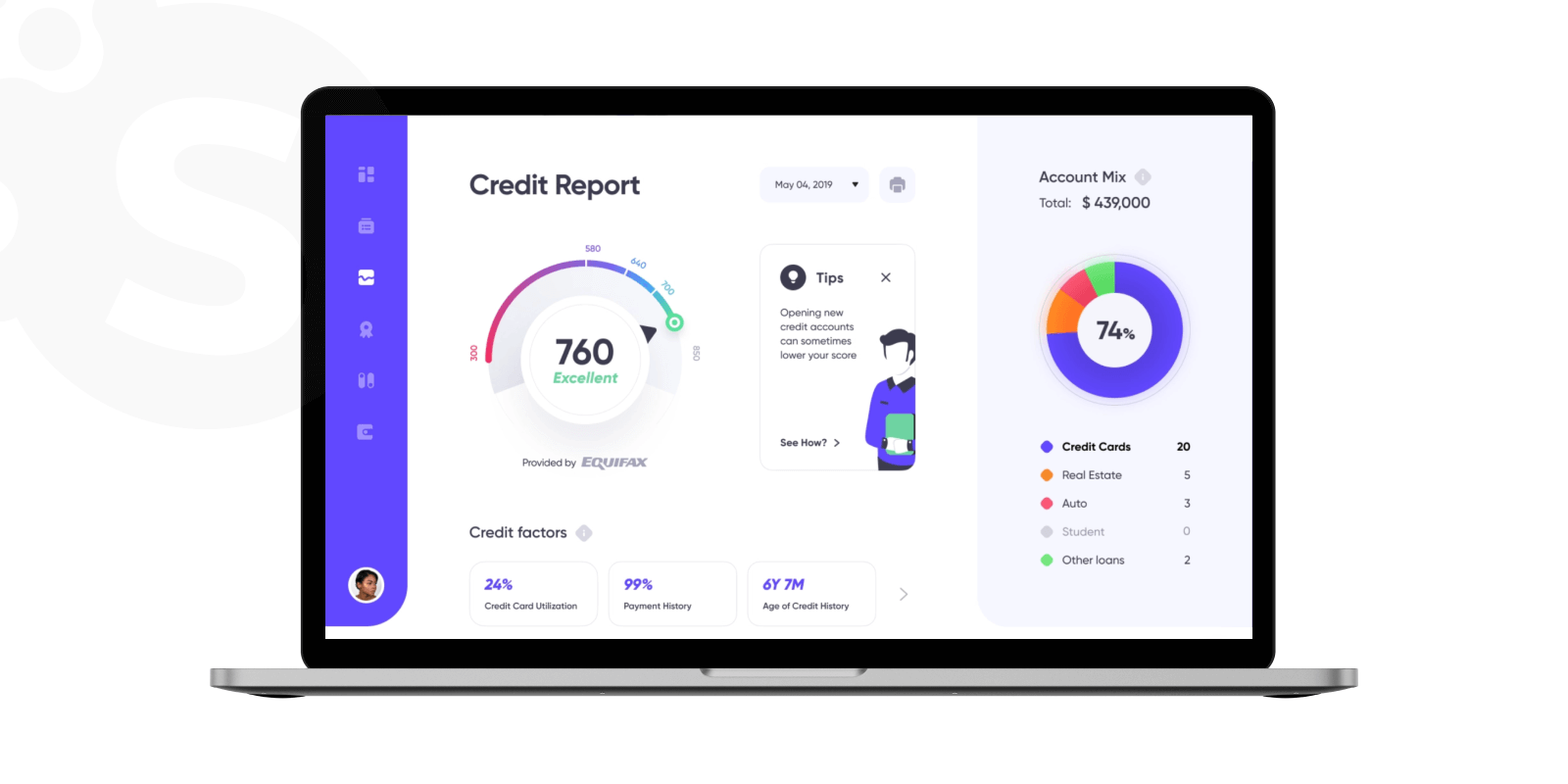

The brand new rating range to possess Borrowing Karma’s credit scores is actually three hundred to help you 850. They are busted into the about three classes, the following:

- Poor: three hundred so you can lowest 600s

- Fair to help you an effective: Reduced 600s to help you mid-700s

- Pretty good and you can expert/exceptional: A lot more than mid-700s

Is actually Borrowing Karma Direct?

Borrowing Karma spends the VantageScore credit-scoring model, that was created by the three big credit agencies-Equifax, Experian, and you will TransUnion-instead of the fresh new longer-created FICO model. Even in the event VantageScore are faster proven to anyone, it claims to be able to score 33 million more individuals than nearly any almost every other design. You to definitely cause is the fact it scores people with little credit score, also referred to as that have a good «thin» credit reports. While younger or recently found its way to the united states, that might be extremely important if you find yourself seeking see borrowing.

Credit Karma will not assemble details about you against creditors however, rather depends on suggestions given to they because of the credit agencies. Therefore its scores are given that appropriate once the any others dependent thereon guidance.

Investopedia achieved over to Borrowing Karma to ask as to why people is believe Credit Karma to include them with a rating that’s an accurate expression of their creditworthiness. Bethy Hardeman, after that captain consumer recommend during the business, responded: «The newest score and you will credit report information on Borrowing from the bank Karma originates from TransUnion and you can Equifax, a couple of about three big credit agencies. We provide VantageScore fico scores on their own out of one another payday loan Idaho Springs credit reporting agencies. Borrowing from the bank Karma selected VantageScore because it’s a collaboration one of the around three biggest credit reporting agencies and is a clear rating design, which can only help customers better understand changes to their credit score.»

VantageScore and you may FICO is both mathematical models put estimate credit ratings considering consumers’ accessibility borrowing. FICO is the more mature and better-recognized model, being delivered inside the 1989. VantageScore made their debut in the 2006.

Comentarios recientes