If a business is using a single entry system, the formula does not apply. Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable. Long-term liabilities are usually owed to lending institutions and include notes payable and possibly unearned revenue.

Limits of the Accounting Equation

- Incorrect classification of an expense does not affect the accounting equation.

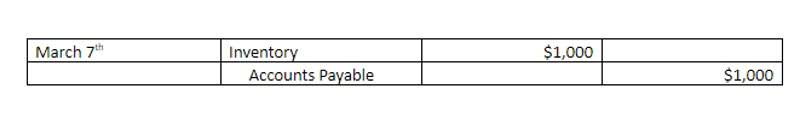

- Double-entry accounting requires you to make journal entries by posting debits on the left side and credits on the right side of a ledger in your balance sheet.

- If you have high sales revenue but still have a low profit margin, it might be a high time to take a look at the figures making up your net income.

- The Basic Accounting Equation is a simple equation that states that the total value of a company’s assets must be equal to the total value of its total liabilities and shareholder equity.

- These basic accounting equations are rather broad, meaning they can apply to a variety of businesses.

- For example, if a company becomes bankrupt, its assets are sold and these funds are used to settle its debts first.

Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage. A liability, in its simplest terms, is an amount of money owed to another person or organization. Said a different way, liabilities are creditors’ claims on company assets because this is the amount of assets creditors would own if the company liquidated.

Final Thoughts On Calculating The Equation

In the same fashion our examples section sets out typical double entry bookkeeping transactions and show how each transaction affects the accounting formula. The dollar amount of assets on the left side of the equation must equal the sum of liabilities and equity on the basic accounting formula right side of the equation. With the accounting equation, you can better manage your business’s finances and evaluate your business transactions to determine whether they’re accurately reported. If both ledgers of your balance sheet don’t match, there may be an error.

The Basic Accounting Equationor Formula

Double-entry bookkeeping started being used by merchants in Italy as a manual system during the 14th century. Metro issued a check to Rent Commerce, Inc. for $1,800 to pay for office rent in advance for the months of February and March. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

As business transactions take place, the values of the accounting elements change. If the net amount is a negative amount, it is referred to as a net loss. After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business.

In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses. The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. Although the balance sheet always balances out, the accounting equation can’t tell investors how well a company is performing. If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

Debt-to-equity ratio equation

Your profit margin reports the net income earned on each dollar of sales. A high profit margin indicates a very healthy company, while a low profit margin could suggest that the business does not handle expenses well. By subtracting your revenue from your expenses, you can calculate your net income.

Angela has used and tested various accounting software packages; she is Xero-certified and a QuickBooks ProAdvisor. Experienced in using Excel spreadsheets for her bookkeeping needs and created a collection of user-friendly templates designed specifically for small businesses. A long-term liability is a debt that must be paid back over a period longer than one year. The most common types of long-term liabilities are bonds and mortgages. Fixed Assets are long-term assets that a company owns and uses in the production of its goods or services. These assets usually have a life span of more than one year and include things such as land, buildings, equipment, and patents.

4: The Basic Accounting Equation

For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount. When a company purchases inventory for cash, one asset will increase and one asset will decrease. Because there are two or more accounts affected by every transaction, the accounting system is referred to as the double-entry accounting or bookkeeping system. The equation states that the total assets of a business must equal the total liabilities plus the owners equity in the business. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity.

While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. The accounting equation states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. In other words the expanded accounting formula shows retained earnings is the link between the balance sheet and income statement. Moreover the income statement is in fact a further analysis of the equity of the business. In above example, we have observed the impact of twelve different transactions on accounting equation.

Comentarios recientes