Exemptions have been eliminated from Federal income tax since the Tax Cuts and Jobs Act (TCJA) was implemented in 2018. However, some states still have exemptions in their income tax calculation. The above paycheck calculator is applicable for calculating paychecks of individuals who have an annual salary, hourly wage, or are seasonal workers or self-employed. Of course, if you opt for more withholding and a bigger refund, you’re effectively giving the government a loan of the extra money that’s withheld from each paycheck. You could also use that extra money to make extra payments on loans or other debt.

Calculate your paycheck in 6 steps

Examples of some common tax credits are separated into the four categories below. Interest Income–Most interest will be taxed as ordinary income, including interest earned on checking and savings accounts, CDs, and income tax refunds. However, there are certain exceptions, such as municipal bond interest and private-activity bonds. Regardless of your situation, you’ll need to complete a W-4 and submit it to your employer. The information you provide on your W-4 will determine the correct amount of tax withholdings. If you’re self-employed your FICA rates are doubled, since you’re paying on behalf of both the employee (you) and the employer (also you).

Save $1,500 a year when you bundle everything you need to run your church!

Exempt employees, otherwise known as salaried employees, generally do not receive overtime pay, even if they work over 40 hours. For more information about overtime, non-exempt or exempt employment, or to do calculations involving working hours, please visit the Time Card Calculator. Lets start our review of the $ 39,000.00 Salary example with a simple overview of income tax deductions and other payroll deductions for 2024. The table below provides the total amounts that are due for Income Tax, Social Security and Medicare. We will look at each of these and a periodic split (hourly rate and deductions, monthly rate and deductions etc.) as we go through the salary example. The credit is equal to a fixed percentage of earnings from the first dollar of earnings until the credit reaches its maximum.

How to calculate Tax, Medicare and Social Security on a $ 39,000.00 salary

- When you think of how much money you make in a year, you probably think of your salary before taxes are taken out.

- Taxpayers can choose either itemized deductions or the standard deduction, but usually choose whichever results in a higher deduction, and therefore lower tax payable.

- Any credit / debit card information that is stored is secured using PCI DSS Level 1 compliant standards.

- But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52.

- The more taxable income you have, the higher tax rate you are subject to.

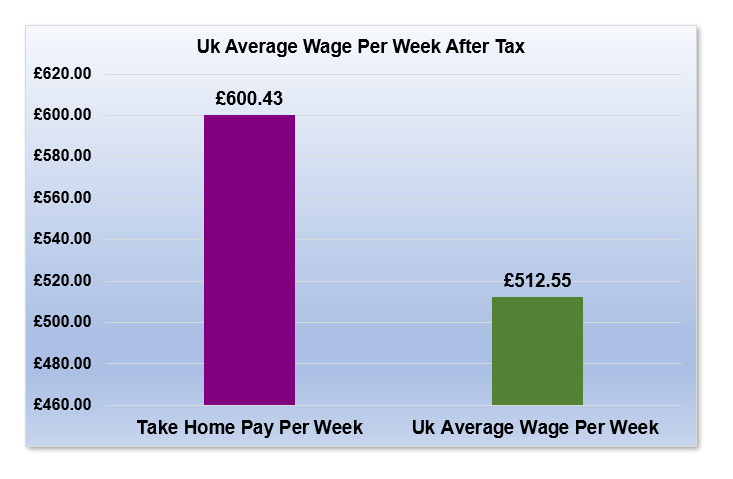

Select your state from the list below to see its salary employee calculator. Yes, it is possible to live off $39,000 a year, but your comfort depends on your location and lifestyle. $39k a year in a lower-cost-of-living area will go much further than in high-cost-of-living areas like New York or San Francisco. The latest reported median household income for Americans was $70,784. All types of households are included in that figure meaning if there are five wage earners or one in a household they were all included. Apart from tax, you’ll also need to pay National Insurance on your £39,000 income.

In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions. These are known as “pre-tax deductions” and include contributions to retirement accounts and some health care costs. For example, when you look at your paycheck you might see an amount deducted for your company’s health insurance plan and for your 401k plan. Pre-tax deductions result in lower take-home, but also means less of your income is subject to tax.

Passive Incomes–Making the distinction between passive and active income is important because taxpayers can claim passive losses. Passive income generally comes from two places, rental properties or businesses that don’t require material participation. Any excessive passive income loss can be accrued until used or deducted in the year the taxpayer disposes of the passive activity in a taxable transaction. It’s important to understand your net pay so you can budget around it—in other words, know how much money you can spend each month on rent, groceries, dinners out and other expenses.

The more taxable income you have, the higher tax rate you are subject to. This calculation process can be complex, so PaycheckCity’s free calculators can do it for you! To learn how to manually calculate federal income tax, use these step-by-step instructions and examples. Get a glimpse into the composition of your paycheck by uncovering the specific amounts you can anticipate earning on a daily, weekly, and monthly basis with an annual salary of $43,000.

At that level of income, your household is higher than the median household income. If you are making $39,000 a year you are making the average salary in the US. If you are living in a low-cost-of-living area you will the individual shared responsibility payment under the aca be able to stretch your dollars even further. You probably won’t be buying a mansion, but the average person making $78000 a year won’t be either. You will pay a total of £5,286 in tax per year, or £441 per month.

Comentarios recientes