At the same time, a debtor who’ll have indicated financial balances by way of discounts are always be provided with most useful solutions due to ideal interest rates otherwise reduce percentage criteria.

Thankfully, fico scores can be constantly be improved when needed. Only to show, it may take sometime, however with specific patient efforts, it is possible to talk about your credit rating as you ready yourself to try to get an interest rate. Information about how:

- Pay all costs promptly each month. Every time you spend your own bill by the due date, you will include worthy of and you will stamina towards the credit rating.

- Start paying your financial situation. Cut back on expenditures where you could and you may pay the monthly costs off. As your obligations-to-income proportion enhances, your credit score may start reflecting it. Debts due are among the choosing situations of having an effective loan, and so the shorter balance, the greater your credit score and ability to secure that loan might possibly be.

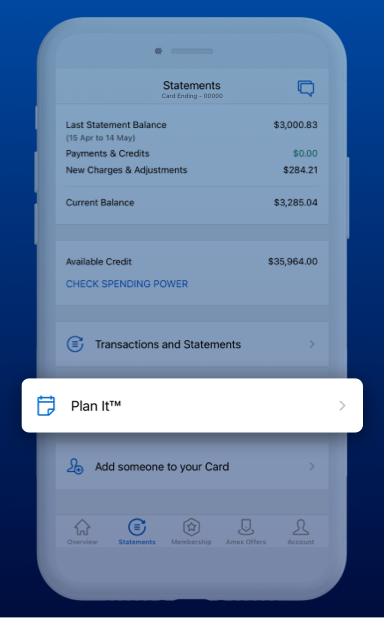

- Be a 3rd party representative into the family’s membership. This might be a good way to possess a family member to help you make it easier to as you initiate their homeownership trip. This would imply that a member of your family could add your own name so you can a charge card your subscribed in order to fool around with. If they spend the money for payment punctually, this can also add tremendous worthy of to your credit history. Cannot increase the amount of expenses compared to that owner’s account; that may simply hurt all your family members associate.

- Check your credit file for blemishes. You could potentially document a dispute to your credit rating service if the the thing is that whatever appears to be an error.

- Hire a cards resolve provider. There are times when then it all you need to get the credit rating examined, and you can top-notch credit repair attributes will help you to understand what need as done to get you where you must be.

Methodology

We used analysis and recommendations off individuals offer, along with Us Lender, Experian, and you may Date, to determine the finest credit history necessary to purchase a home.

Faqs

With regards to the kind of financing you are seeking and get, the very least credit history off 580 might end up being required to secure that loan on the home.

Sure, you could potentially. Dependent on and therefore financial you select and conditions regarding specific financial institution, they may even allow for credit ratings less than 600.

The newest Government Houses Administration set FHA criteria, including a minimum credit rating regarding 580 and at least advance payment away from step three.5%.

700 is a wonderful credit history to help you secure home financing. Which have an excellent 700 credit score, the most suitable choice is a traditional financing. not, make sure to have sufficient money on give to own a bigger down payment. Old-fashioned financing tend to have top rates complete.

Conclusions – What Credit score Is needed to Get A house?

In relation to purchasing a property, think about what you’re asking the lender to-do to you personally. You are guaranteeing to expend straight back repeatedly a substantial matter of cash over a long span of day. Naturally, borrowers will want to evaluate every selection, but knowledge your credit rating and the lender’s lowest standards tend to help painting a significantly clearer photo before you go to get your first or 2nd house.

This would be also a lot of fun to begin with examining the costs. You can test purchasing several of the money you owe down and reducing one so many repeated costs. Dump people frivolous repeated memberships and maintain your general paying down.

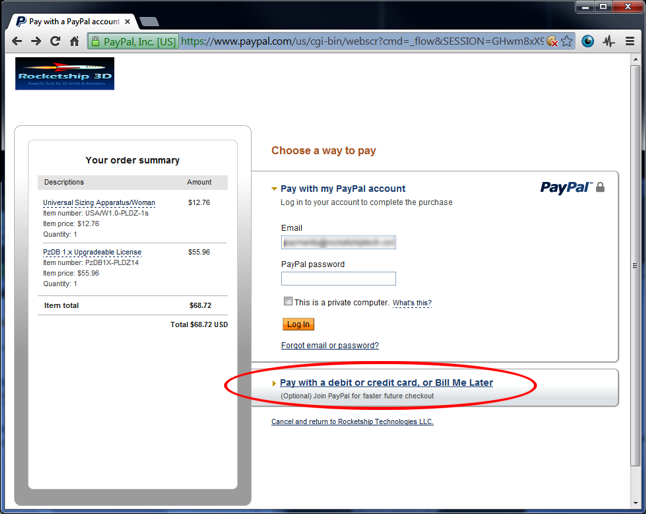

A different crucial foundation right now is and also make the individuals monthly obligations repayments punctually. Auto and you will credit card money are advertised back once again to the credit enterprises, visit this link and we also do not want people blemishes on your own credit report to help you stop you from getting that loan.

Comentarios recientes