Tax Ramifications out of Leasing Vacation Assets

To ensure a holiday the place to find end up being classified while the an effective house by the Irs, it ought to provide very first life style leases and additionally resting place too given that cooking and you will restroom organization. The home should be taken private purposes for a whole lot more than 14 days and you may 10% of the total number of months the home try leased at the a good local rental worth.

The holiday household tax guidelines to own a home often pertain if people conditions are found. Deductible expenses would include the new rental part of certified home mortgage interest, real estate taxation, and you may casualty losses. Most other expenses that is certainly deducted stem straight from the leasing assets you need to include ads, payment away from commissions, courtroom fees, and work environment provides. Expenditures connected with the constant maintenance and procedure of the local rental property are deductible.

In the event that a vacation home is rented away to have fifteen days otherwise a great deal more annually, the leasing money have to be advertised for the Irs (IRS) playing with Plan Age. Citizens may subtract any expenses associated with one household. If your house is sensed your own house, the newest deducted expenses www.availableloan.net/personal-loans-ny/cleveland cannot go beyond the new rental money. In case your travel house is not an individual house, new deducted costs can also be meet or exceed so it tolerance, however the stated losses can be simply for inactive-activity laws.

Monetary Effects from Buying Trips Family

Getting a vacation house is generally economically comparable once the possessing a great primary house. Where light, there are many different economic areas of having a holiday family, definition the particular owner need certainly to imagine more than simply the purchase price of the little bit of home it purchase. Below are the most famous functioning will set you back a holiday homeowner can expect so you’re able to incur.

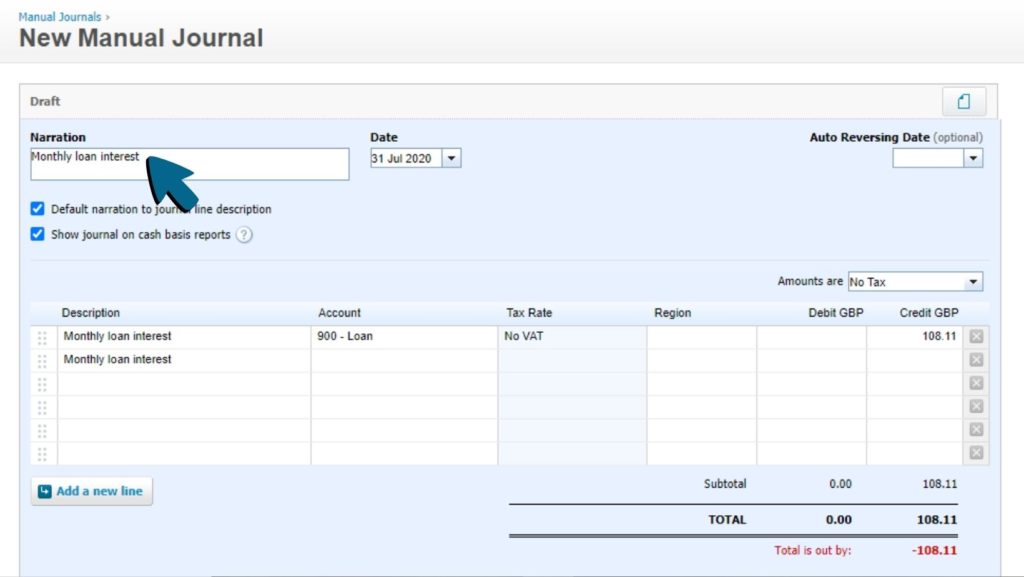

- Mortgage repayments/Interest: For those who grabbed out a home loan order your trips household, you will need to generate regular home loan repayments. And additionally paying down the principal equilibrium of the financing, you can easily happen focus expenses that’s heavy at the beginning of your loan if dominant balance of the home loan is high.

- Assets Taxation: According to location and value in your home, you can also shell out several thousand dollars inside assets taxation each year. Property taxes are now and again recharged twice a year, even though some people may be required to spend possessions taxation into the a keen escrow membership administered because of the mortgage lender to make sure fast and you may fast remittance away from possessions tax examination.

- Repairs/Maintenance: Keeping a secondary house will be costly. You will need to budget for such things as clean up, surroundings, repairs, and you will updates. You could propose to carry out all these affairs on your very own or get contract these services so you’re able to other people (will from the increased pricing).

- Consumables: No matter if maybe not a direct family costs, you will need certainly to take into account the cost of filling consumables per big date you go to your vacation family; such, you may need to fill-up this new ice box whether your remains was quite few.

- Insurance: You will have to guarantee your vacation home so you can include it out-of damage or thieves. The bank may need a specific level of visibility, plus insurance policies cost is commonly myself synchronised into the worthy of, venue, and differing risks of your property.

As well as the constant expenses significantly more than, travel people need certainly to envision just how properties could possibly get fluctuate in really worth. The market industry cost of a property can get increase otherwise decrease mainly based towards the prevalent macroeconomic requirements for example economic rules, rates of interest, or globe have.

Promoting Travel Property

When the owner off a secondary home sells the house, they have to imagine implications to your funding gains. Normally, these financing increases have to be claimed to your Internal revenue service. This is because vacation home was treated as the personal financial support assets. Customers are taxed to your winnings of one’s purchases, that are claimed toward Plan D, into 12 months the house are sold. This form comes with the new user’s annual taxation return.

Comentarios recientes