Lifestyle would be unstable. This is exactly why it is essential to comprehend the signature loans and you may financing selection that will help you funds the latest unexpected and you may policy for the trail in the future.

Thus, just what consumer loan suits you? Listed below are a variety of choice which can be used to help you let finance whatever life puts the right path.

Personal loans

If we want to pay down obligations, consolidate loans, cover unexpected expenditures or buy something, an unsecured loan could be the tool that helps you achieve your targets.

Personal loans is generally a diminished-rates alternative to playing cards and you can a simpler software procedure than other credit choice. The interest rate of the mortgage utilizes a number of facts together with your credit history, debt-to-earnings ratio, the level of the mortgage plus. In addition, you are able to safer faster funds rather than equity if your meet with the mortgage criteria.

Mortgages

Have you been likely to purchase property otherwise seeking to refinance your current home? There are a number regarding home loan choice dependent on your financial demands:

- Old-fashioned mortgage: Old-fashioned home loans arrive through a few authorities paid organizations-Federal national mortgage association and you can Freddie Mac computer. Traditional finance are now able to become closed having only step 3% downpayment. However, remember that private home loan insurance policies perform apply for down money below 20%. Antique mortgages will be most frequent financial support questioned for buying good household.

- Government Houses Government (FHA) mortgage brokers: FHA lenders are protected by authorities. These mortgage brokers can handle borrowers who don’t have the loans to get to know brand new downpayment criteria from a normal mortgage. FHA finance also have alot more flexible degree standards, which make them appealing to people who will most likely not qualify for old-fashioned mortgage loans. You to definitely caveat for FHA loans is because they have some limitations and you can constraints on your house buy of dollar add up to specific attributes of our home.

- Pros Factors (VA) home loans: Virtual assistant funds is actually mortgage loans protected of the Company regarding Veterans Factors. Virtual assistant financing offer enough time-identity financial support so you can qualified Western experts otherwise their enduring partners which meet specific official certification.

- Jumbo mortgages: A jumbo home mortgage have an amount borrowed that is higher than traditional mortgage parameters and that’s designed to match higher-well worth land greater than $647,000.

- You Agency regarding Agriculture (USDA) lenders: The latest Rural Casing Solution (RHS) are a management department for the U.S. Institution off Agriculture (USDA) one to manages mortgage software centering on outlying homes to have lenders so you can promote on their organizations. USDA money let reasonable-income individuals in the rural areas and pledges funds one see RHS criteria.

Family security finance and domestic security credit lines (HELOC)

For people who already own property, you could place your family well worth to work with home security capital. If you take advantage of their home’s security, you could safety the costs regarding renovations, get otherwise refinance a car or truck, purchase high costs or consolidate the debt.

One thing to see throughout the house security ‘s the more methods for you to use your home to submit a funds shot the 2 primary of them is actually a home equity personal line of credit (HELOC) and you will a home equity loan, that is certainly entitled the second mortgage.

So, how do you see which is most effective for you? An excellent HELOC was a reusable line of credit where your residence functions as collateral that have either varying or repaired costs. With this investment alternative you may spend what you need. Payment quantity may differ depending on how most of your HELOC you employ and also the interest. A beneficial HELOC is fantastic lingering costs for example strengthening your ideal kitchen otherwise making house fixes.

A house equity financing is a swelling-contribution loan where your house serves as equity. This type of financing have a predetermined rate, consistent payment quantity and you might have the total amount from the financing closure. It loan is usually employed for to make high, one-go out instructions or remodeling your property.

To acquire a property is just one of the prominent instructions a person will make within lifetime plus the application for the loan techniques can appear to be a daunting task. not, there are various info available eg a mortgage loan Listing to help you help you collect the necessary files and flow efficiently from app processes.

Automobile finance

Purchasing a vehicle is a big decision and it is crucial one to you feel positive about you buy. An individual car loan funds processes starts with a peek at the money you owe and financing requires. Your bank would be truth be told there to help you every step off the way when you look at the get which have a car dealership or individual supplier.

If you are searching so you can re-finance a motor vehicle, get in touch with their banker to examine your car or truck financial loans. An up-to-date private car or car loan title ount, and you can have the ability to take advantage of a reduced speed. People may not be aware that automobile fund may include a lot more than simply an automobile. Of many loan providers render investment to have relaxation vehicle off ships and you can engine home, to help you motorcycles and you will ATVs.

Avoid higher-chance money

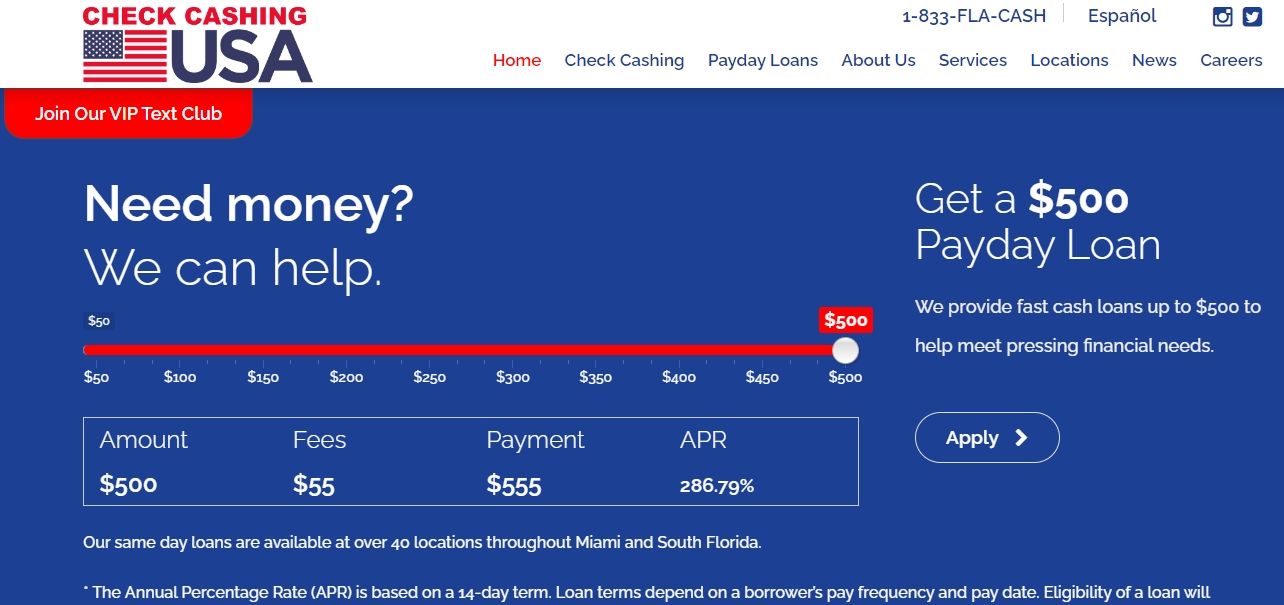

If you want money prompt and you will discover you may have complications protecting that loan on account of factors such as for instance reduced credit scores or a top financial obligation-to-earnings proportion, it can be appealing to do business with head lenders that offer easy-to-safe financing rapidly. Yet not, funding options eg pay day loan, buy-now-pay-afterwards and you may identity finance often have quite high rates and you can charges.

If you find yourself these selection seems like a magic pill, they often do a whole lot more monetary filters to possess borrowers. In reality, centered on Borrowing Conference, merely 14% from cash advance consumers pays straight back their financing.

Discover a multitude of capital options that can see your very own lending need. Having a closer look in the exactly how per option can impact their money, UMB’s hand calculators can help you target preferred monetary demands also mortgage refinancing, auto repayments, debt consolidation reduction and more.

UMB private banking possibilities promote benefits and you loans Blue Valley may convenience to get to know all of one’s prior, introduce and you can coming monetary need. At home loans so you’re able to auto capital and you may everything in anywhere between, observe how UMB personal financial can perhaps work with you to find suitable points for the lifestyle and lives.

Once you simply click website links designated on icon, you are going to log off UMB’s webpages and you may check out websites which can be not subject to otherwise connected to UMB. I’ve offered these website links for your convenience. Although not, we do not promote or make certain any products or services you get view on other sites. Most other other sites elizabeth privacy regulations and you will defense measures one UMB does, very please feedback its rules and functions meticulously.

Comentarios recientes