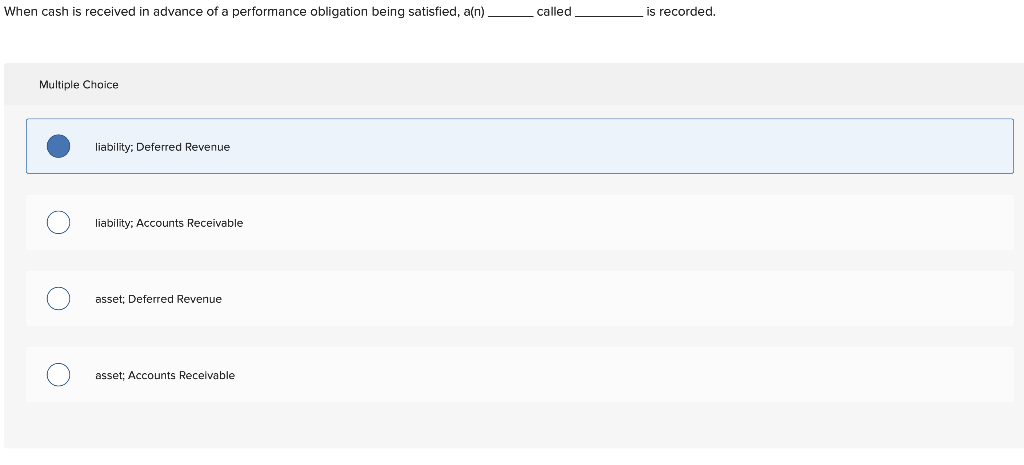

One self-confident development in the brand new latest manage-right up of prices is the fact of several property owners currently have substantially more equity. The typical mortgage holder now retains $299,000 in the collateral, at which $193,000 are tappable , meaning they might acquire this much when you are however that have 20% guarantee in their home.

Which have which collateral are valuable, such should you want to put a big deposit on your own second home. It is helpful to use now, when used intelligently. For example, if you have large-attention financial obligation, such as for example personal credit card debt, you could potentially benefit from taking out a home guarantee distinctive line of credit (HELOC) or property collateral financing to consolidate obligations.

However, HELOCs and home security money are not similar . HELOCs provide a credit line that one may obtain off as needed, generally with a period of focus-only payments, followed closely by appeal-plus-dominating payments, with varying rates . At the same time, domestic equity loans provide a lump sum payment at a predetermined appeal rates, that have place principal-plus-appeal money from the start.

There clearly was advantages and disadvantages to each other choices when it relates to making use of your house collateral to have debt consolidation reduction , since the we will mention right here.

Whenever an effective HELOC could be perfect for debt consolidating

- You would like freedom: «An effective HELOC helps to make the extremely experience when you need independency into the their credit. Inside draw several months, you might borrow against the offered harmony as required, spend it off, and borrow once more. Simply put, you might use exactly the count need when you need it in lieu of taking out fully a lump sum loan,» states Leslie Tayne, originator and you may lead attorneys in the Tayne Legislation Class.

- You ought to briefly acquire a small amount: «As far as debt consolidation goes, a great HELOC is generally prominent whenever expense are relatively reasonable opposed in order to equity home, and it will try to be a connection resource up until borrowing from the bank enhances to make to another origin, for example individual fund,» states Aleksandar Tomic, assistant dean to have means, innovation, and you can technology at the Boston School.

- We need to postponed principal costs as well as have an intend to pay-off the bill: «When the a borrower refinances established costs having a beneficial HELOC featuring an interest-merely several months, this new loan commission is dramatically less than their current financing repayments within the attention-simply months,» states Timothy Holman, elderly vp, head out-of domestic lending, Northwest Bank. But not, you want to make sure you pays the main off, whether which is by using a beneficial HELOC due to the fact connection funding if you do not are able to find a loan with greatest words, or perhaps you can also be soon pay-off a full financing with bucks. «Some consumers get elect to make the down focus-just costs into a HELOC when they know that they will found an enormous amount of cash to pay it off within the the long run, including of selling your house, inheritance, settlement, incentives, etcetera.,» says Holman.

Whenever property guarantee mortgage could be perfect for debt consolidation

If you’re HELOCs offer professionals in lot of circumstances, house security finance are sometimes finest having debt consolidation reduction , such as for instance whenever:

- We need to generate improvements on your own financial obligation incentives: One problem with HELOCs is that you might be consumed when you are capable of making attract-simply money, however, that doesn’t decrease your financial obligation equilibrium. But with property guarantee mortgage, «you only pay from a touch of your debt each month. That is crucial if for example the objective would be to spend what you from and you can become loans-100 % free. You realize exacltly what the payment per month shall be in the years ahead as well as how enough time it will require to pay off the» family equity mortgage, states Adam Spigelman, older vp on Entire world House Credit.

- We try this web-site would like to combine at once: «If you know the number of personal debt you ought to consolidate and don’t welcome wanting most funds in the future, property guarantee financing will bring a lump sum payment that one can used to obvious the money you owe all at once, without the attraction so you can acquire a whole lot more,» says Tayne.

- You would like balance: Some borrowers favor varying prices with HELOCs, eg if they pledge costs drop later on. But others require new predictability regarding a predetermined-rate house collateral loan . When you are house security costs regarding principal and interest are often far more than desire-just repayments into an equal-size of HELOC, «the new borrower has no to be concerned about upcoming price change,» states Holman, and know precisely exactly what the prominent costs look like from the start. «In the event that a borrower has no clear intentions to pay-off this new principal afterwards,» following a house security financing is the much more controlled choice, says Holman.

The bottom line

Each other HELOCs and you may domestic security finance provides its pros, additionally the option to use household collateral borrowing to own debt consolidating depends on things just like your debt benefits timeline additionally the dimensions of one’s obligations. «Deciding on the best financial is very situational. Your credit score, simply how much we need to obtain, your earnings, and your financial needs every come into play,» says Spigelman.

Comentarios recientes