step three. Murabaha was a design where financier buys your house and you can offers it for the consumer on a beneficial deferred basis within a decided-abreast of cash. The consumer will pay a deposit and you can repays the financier more than a good time, also an income costs with each payment. This is not financing which have notice – it is a resale with a great deferred payment.

The last one or two activities provides tall cons. From inside the Ijara, the home customer is largely a tenant for your several months of one’s contract and won’t gain benefit from the benefits of homeownership up until repayment is finished. At the same time, Murabaha creates an obligation on the household consumer one to resembles obligations. Thus Diminishing Musharakah has been deemed by extremely highly respected students from inside the Islamic money due to the fact best bet, and it is the brand new approach taken by the Information Home-based just like the inception inside 2002.

In regards to the Co-Ownership Model

Suggestions Residential’s exclusive model of Islamic a home loan are an application regarding Shrinking Musharaka titled Declining Balance Co-Possession. Inside model, as the home client and you will Guidance Domestic invest in getting co-owners of a certain property, both activities buy the household to one another. The fresh percent of the property belonging to both parties is decided from the for every side’s financing. (For example, if for example the domestic consumer will pay 20% of one’s cost, they have 20% of the house, and you will Suggestions possesses 80%.) Our home customer after that renders monthly premiums in order to Pointers Domestic, increasing the show they’ve up until he’s got ordered all of Recommendations Residential’s possession share. Then your domestic customer gets the actual only real proprietor of the property.

Within this model, our home buyer benefits from possessing and you may located in your house well before he’s got complete to get Recommendations Residential’s express on assets, so they really shell out Guidance a charge for playing with Guidance’s express out-of the property

One benefit from the design is that, given that Co-People who own the property, Information Domestic shares the dangers out of home ownership with you. And you can charge is actually capped, without this new undetectable costs out-of a classic home loan.

An overview of the brand new Islamic Home buying Process

To buy property that have Islamic money requires the exact same five methods one some other You.S. house buy needs: application, running, underwriting and you may closing. The real difference is the fact that the price is halal, or sharia-compliant.

Step 1. Qualification or Software

The initial step is always to offer Information Home-based that have earliest advice about you plus money being discover just how much funding you could qualify for.

You could begin with an instant Pre-Certification at the beginning of their travel if you need to obtain a crude imagine of the house rate you might be ready to cover. But you can along with forget about one optional step and you can flow individually to the Pre-Recognition Application.

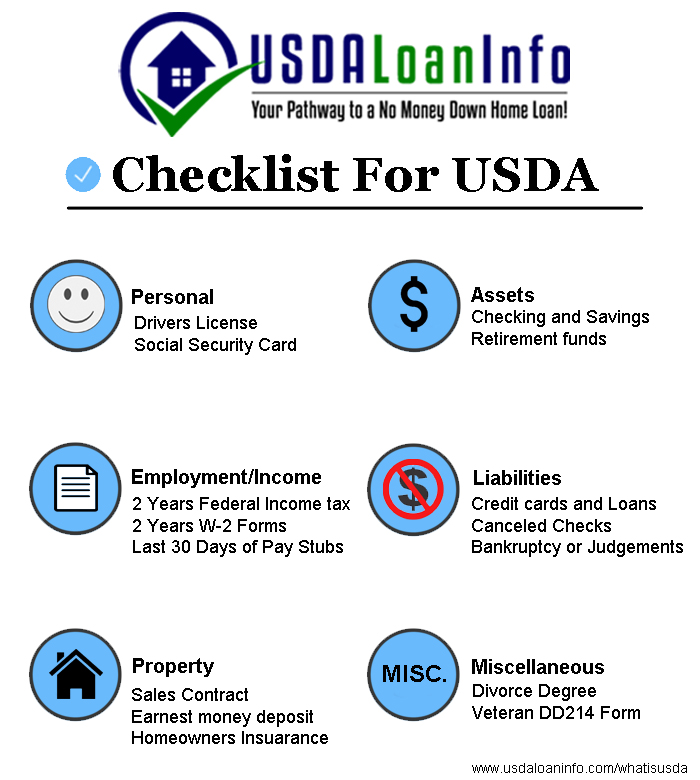

Once you fill in the Pre-Acceptance app, you’ll fill out records of information like earnings, work and deals. An effective financier commonly guarantee the application and you can let you know what investment you may also be eligible for. Are Pre-Approved means you are prepared to genuinely start to look for property – Real estate agents tend to predict you to getting Pre-Approved before it guide you house. Pre-Recognition is also step one if you prefer in order to refinance a house you already individual. Our very own on the web app strolls you from procedure and you will payday loans Oklahoma causes it to be an easy task to over anytime you like.

After you build a deal towards the a house plus contract could have been accepted by the seller, just be sure to complete the application for funding that certain property. If you have been Pre-Acknowledged, a lot of work are certain to get come complete.

Comentarios recientes