- Independence towards Property Type of: DSCR fund can be used to money unmarried-members of the family property, condos, condotels, non-warrantable apartments, and you can multiple-family relations (2 to 4-unit) attributes.

New zero-income verification function ensures that dealers can be be eligible for a loan based on the potential local rental income of the house rather than its individual earnings, that is very theraputic for people who have non-traditional earnings source. This feature in addition to simplifies the applying processes, minimizing the need for extensive paperwork, particularly jobs record and financial statements.

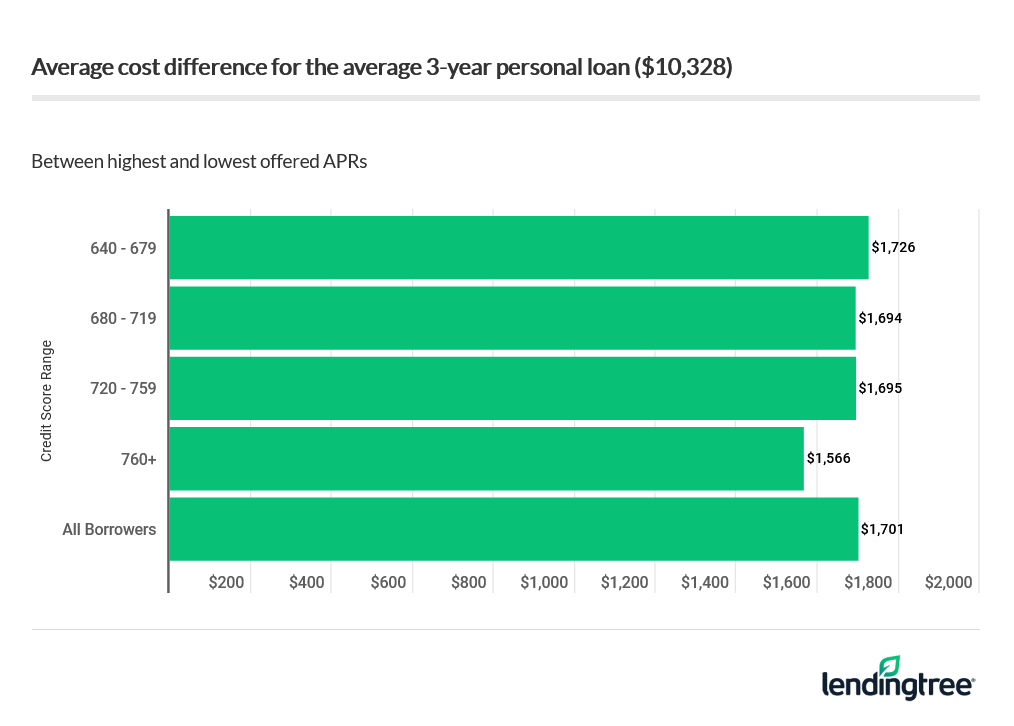

DSCR money likewise have a number of disadvantages. They frequently have large attract ratesthan traditional mortgage loans owed toward improved chance with the zero-earnings confirmation techniques. There might be also limitations on the version of qualities qualified to possess DSCR financing.

One disadvantage with the DSCR mortgage design is that extremely real estate dealers lean towards the and come up with bucks even offers. However, leverage good DSCR loan can allow them to generate bigger orders. As well as, DSCR funds can be used to cash out in your established possessions and employ the cash proceeds to pay for your future financial support – without having any personal money verification.

Just how do DSCR Money Compare to Other Resource Choices?

DSCR finance bring a different sort of opportunity for a home dealers, such individuals with low-traditional earnings provide. The flexibility makes them an appealing option for of numerous people. not, it’s important to think how they compare with additional options round the the newest board.

Traditional Mortgage loans

Conventional mortgage loans, for example a conventional financial or FHA, are definitely the most commonly known style of capital the real deal home sales. This type of financing require full income confirmation and you may a comprehensive credit check.

If you find yourself conventional mortgage loans generally speaking provide straight down interest rates and longer repayment conditions compared to DSCR loans, they also need large documents and will take a longer period to close off. That it downside could well be a package breaker when day is actually from the newest substance so you’re able to secure a good investment opportunity.

Hard Money Loans

Exactly like DSCR finance, tough money finance was brief-term finance normally utilized by people who want brief capital otherwise who have been refused by the conventional loan providers.

Difficult currency funds change from DSCR financing since they’re advantage-centered. The home, maybe not the cashflow, serves as security if there is standard. Such finance promote rates and you may independency but will include dramatically higher rates of interest than old-fashioned mortgages.

Such finance are typically suited to dealers probably rehabilitation and you may offer the house or property easily in lieu of maintaining the house because the an effective revenue stream.

Private Currency Financing

Individual currency financing act like hard money loans, for the number one huge difference becoming that fund are from private anybody or groups as opposed to organization loan providers. Individual lenders prioritize strengthening a love and their members and you will partners, that money offer considerable flexibility about mortgage terminology and you can criteria.

They’re not regulated the same as loans. The same as hard money money, they typically have large rates and you may quicker installment terms, but the advantageous asset of individual money funds is dependent on the flexibility and you may price, making them good for buyers who are in need of short capital.

Link Loans

Connection loans, otherwise portfolio financial support, are short-term fund built to «bridge» new gap between the acquisition of another bad credit personal loans New York property together with income from a current one to.

connection investment is commonly utilized by dealers who want quick funding to secure a home while they wait for profit of an alternative possessions or to promote by themselves additional time to help you be eligible for long lasting financial support. Identical to difficult currency and private money money, rates and you will freedom already been at the cost of high rates and you can a notably shorter turnaround big date, which have payment constantly questioned contained in this per year.

Comentarios recientes